The Boardroom As Theatre

THE ACQUISITION OF LVMH ON TIFFANY & CO. EXPLAINED AS A THEATRE

THE PERFORMERS

BERNARD ARNAULT

At centerstage stood Bernard Arnault, LVMH’s Chairman and CEO. A man famed for turning restraint into dominance. Around him: Jean-Jacques Guiony, the CFO who spoke in numbers rather than words, and an army of legal and strategic advisors.

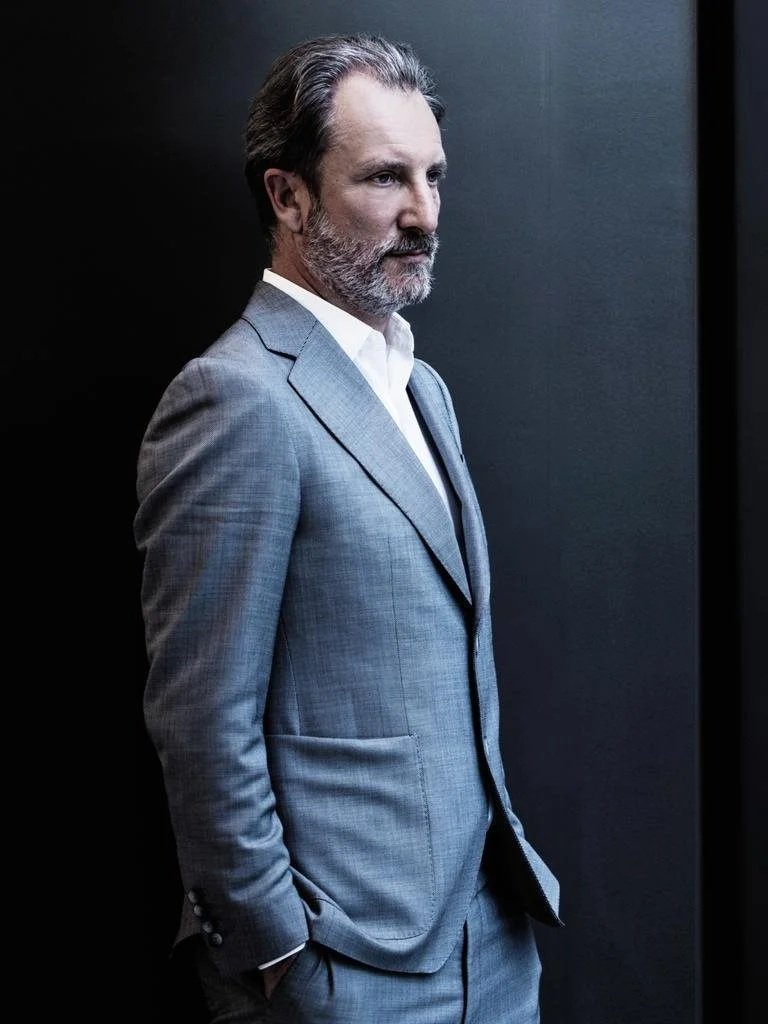

ALESSANDRO BOGLIOLO

Opposite them, in Tiffany’s boardroom, sat Alessandro Bogliolo, the Italian CEO and former Bulgari executive charged with reviving Tiffany’s fading glow. His mission was noble yet fragile: to modernize a 182-year-old symbol of American romance while defending it from an empire built on acquisition.

ACT I — THE CAST AND THE COURT

When the curtain rose on November 25, 2019, the luxury world watched its grandest performance: LVMH Moët Hennessy Louis Vuitton SE’s $16.2 billion acquisition of Tiffany & Co. For $135 per share in cash, Bernard Arnault bought the American jeweler outright. Tiffany’s shareholders exited with money, not influence. The blue box now belonged to Paris. Yet behind the elegance of the deal lay a drama of power, an act of strategy, persuasion and emotional mastery played out across two boardrooms, one in Paris, the other in NewYork.

When the merger was announced, the theatre opened with applause. Tiffany’s share price hovered near $120, and Arnault’s move looked visionary, strengthening LVMH’s weakest division, watches & jewellery, while gaining a commanding presence in the U.S. market.

ACT II — THE CRISIS

Then came the plot twist. March 2020: the world shut down. Luxury sales plummeted. Arnault, ever the tactician, hesitated. Could a $16 billion promise survive a pandemic? In Paris, the LVMH board debated withdrawal; lawyers cited “material adverse change. ” In Washington, a letter from the French government conveniently advised postponement.

In New York, Bogliolo refused to yield. Calm yet unbending, he urged Tiffany’s directors to sue LVMH and enforce the agreement. His argument was simple but piercing: honour and reputation outweigh temporary chaos. Tiffany filed suit in Delaware, a quiet act of defiance that shifted the balance of power.

For months, silence hung between the two sides like the pause before a final act. Arnault’s restraint met Bogliolo’s conviction. Each move was calculated; neither could afford emotion, yet both relied on it.

ACT III — THE RESOLUTION

Negotiations resumed behind closed doors. Arnault, the monarch of luxury, and Bogliolo, the steadfast steward, rewrote the ending. The acquisition would proceed at a lower price of $15.8 billion. For LVMH, it was a practical win; for Tiffany, a dignified survival.

When the deal closed in January 2021, Bogliolo stepped down with a golden parachute, his role complete. Arnault installed Anthony Ledru, a trusted LVMH executive with experience at both Louis Vuitton and Tiffany. The symbolism was perfect: the heir of the empire now presided over the conquered house.

Under Ledru’s leadership, Tiffany became sleeker, louder, and more global. Within months, LVMH’s jewellery division nearly doubled its revenue share, and the group’s stock climbed to record highs. The applause came from investors, not audiences.

ACT IV — THE LESSON OF POWER

What remains after the curtain falls is not just a financial triumph but a lesson in strategic dominance — the quiet art of power that Robert Greene might have admired. Arnault’s mastery lay in restraint: he delayed, negotiated, and ultimately gained control on his own terms. Bogliolo’s strength lay in integrity, persuasion under pressure. Both exercised emotional intelligence, not impulse; they understood that in corporate warfare, the calm mind conquers.

In the fashion industry, this pattern repeats like choreography: golden parachutes, silent exits, and reshuffled heirs. Behind every glossy campaign lies a war of influence, fought with charm instead of violence. Control over perception, whether of beauty, heritage, or brand value, is the true currency of luxury.

Finance, at its highest level, is not about numbers alone but psychology: knowing when to speak, when to wait, when to yield just enough to win. Power, like elegance, is best exercised invisibly.

EPILOGUE

By the end of this corporate drama, Tiffany’s shareholders had their cash; LVMH had its crown jewel. Arnault expanded his empire without ever raising his voice. And Bogliolo, the defeated yet dignified knight, walked away enriched — proof that in luxury, even exits are gilded.

The boardroom, after all, is the most sophisticated stage of them all. Its actors wear tailored suits instead of costumes, but their motives, ambition, pride, and legacy, are the same as in any tragedy. And in this play, the final applause goes not to the loudest performer, but to the one who controlled the script from the start.